Funds Flowing Out Amid Heightened Concerns?

Advertisements

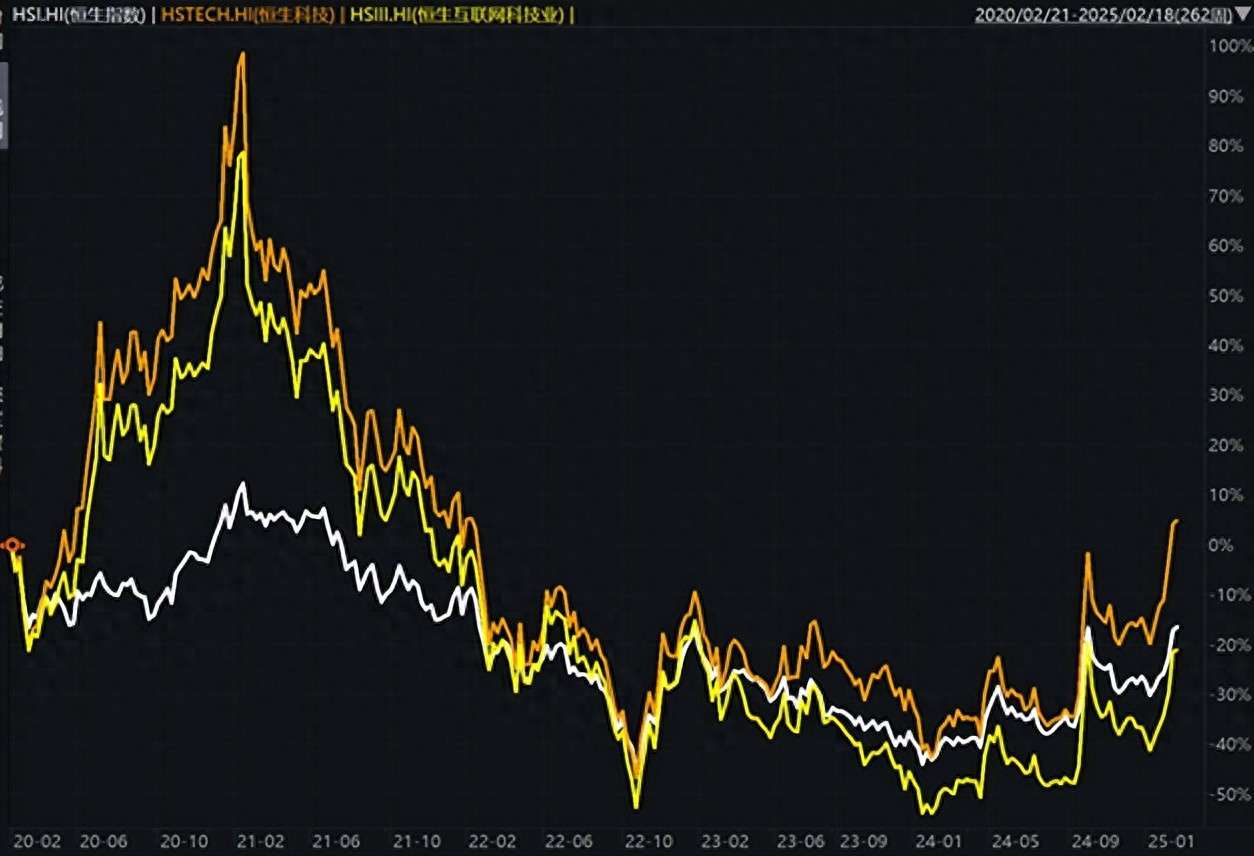

In recent weeks, the Hang Seng Technology Index and the Hang Seng Internet Index have experienced a remarkable surge of over 30% since their lows in January. However, contrary to this bullish trend, there have been significant outflows from their corresponding exchange-traded funds (ETFs), with net withdrawals of over 1 billion and 3 billion respectively in just the past week. Such dynamics raise a pertinent question: does the increasing trend of withdrawals signal that these bullish movements are nearing their peak?

To gain a clearer understanding, we must first explore the nature of ETFs and the behaviors of investors within the trading landscape. ETFs are designed to passively track the fluctuations of underlying indices, meaning that their net value closely follows the movements of the benchmark they are tethered to. It is not uncommon for investors to consider taking profits when their investments soar by substantial percentages, especially after a prolonged period of stagnation that can last several years. Historically, when observing the flow of funds across various ETFs, it becomes apparent that those which have amassed significant gains within a brief timeframe are often subject to the same pattern of increased withdrawals—a scenario commonly referred to as the "sell-on-the-way-up" phenomenon.

This behavioral trend can be attributed to various psychological drivers among investors, including loss aversion and shifting risk appetites. As an investment appreciates to a certain threshold, investors' tolerance for risk typically diminishes. This aversion prompts a stronger inclination toward realizing profits as the perceived potential for loss grows. Furthermore, if the scale of redemptions intensifies within a short window, it could exert pressure on the market. In extreme cases, concentrated withdrawals can even precipitate a sharp downturn. However, considering the current landscape, the Hang Seng Technology and Internet ETFs have market sizes exceeding 20 billion CNY. Based on recent redemption volumes, there is no immediate reason for concern regarding this risk.

Shifting our focus back to the market itself, Hong Kong stocks have seen considerable appreciation since the beginning of the year, especially when contrasted with the A-shares market. This raises a critical point for consideration: are Hong Kong stocks currently overpriced? The answer may defy preconceived notions. From the perspective of market performance, indices such as the Hang Seng Index, the Hang Seng Technology Index, and the Hang Seng Internet Index saw more than three years of oscillating corrections from their peaks in early 2021. They remain substantially distant from their previous heights, suggesting plenty of room for further growth.

To analyze investment opportunities in the Hong Kong market more effectively, we can conduct both vertical and horizontal comparisons in terms of valuation. Vertically, the Hang Seng Index currently sits within a reasonably acceptable valuation band—its price-to-earnings (P/E) percentile ranks at over 60%, indicating that it's positioned slightly higher than the median over the past five years. Conversely, the Hang Seng Technology Index presents a much lower P/E percentile of approximately 31%, suggesting ample potential for upward movement based on historical valuation metrics. When we extend this comparison to global markets, Hong Kong stocks are significantly undervalued compared to their counterparts in the U.S., Japan, and Europe. Commonly used valuation metrics such as price-to-earnings and price-to-book ratios reveal that asset prices in Hong Kong are comparably low, even establishing it as a value haven within the global capital market landscape.

This undervaluation lends Hong Kong stocks a substantial appeal from both a short-term recovery perspective and a long-term mean reversion standpoint. Although the market may encounter some technical corrections in the short term due to overbuying pressures and fund outflows, a mid to long-term analysis reveals a gradual clarifying of uncertainties surrounding Chinese assets. Such developments enhance their investment allure.

It's also essential to highlight that, unlike many other Hong Kong ETFs, the Hong Kong Consumer ETF has not seen any net redemptions despite the recent market rally. Instead, it has attracted continued net inflows of capital. This ETF, which tracks the CSI Hong Kong Consumer Theme Index, reflects an arena woven tightly with the stories of Chinese consumers, often highlighting sectors that are difficult to overlook in the A-shares market. Traditional consumer stocks, such as liquor and home appliance companies, have dominated the narrative.

However, the Hong Kong consumer sector diverges as it focuses primarily on emerging consumer categories that remain rare in A-shares. For example, the constituents of the Hong Kong Consumer ETF include familiar giants such as Alibaba, Tencent, Meituan, and Xiaomi, alongside newer entrants like Pop Mart, Nongfu Spring, and Hai Di Lao. Noteworthily, there are numerous rising stars within the consumer space, which have recently emerged and present significant growth potential, marking a distinct departure from the traditional consumption story. As we engage with the Hong Kong market landscape, it becomes clear that our focus should not be narrowly restricted to technology indices; representative assets like the Hong Kong Consumer ETF equally merit attention and could potentially unveil substantial developmental opportunities.

Leave a comments